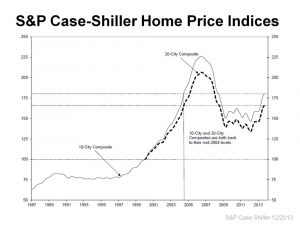

Home values continued to climb in 2013, and the S&P Case-Shiller Home Price Indices reveal that the top 10- and 20-city composites have reached prices similar to the levels of mid-2004, before the housing bubble. From June 2012-June 2013, housing price rose at a fast pace because of the lack of inventory. With fewer hourses on the market, demand increased for the houses that were there, and prices climbed accordingly. As demand leveled off, a typical occurrence for winter home sales, prices steadied. In Wisconsin, prices remained extraordinarily steady in December, with a slight change compared to November sales at -.1%. Steady prices during winter months closed out the year strong, with price appreciation in Wisconsin at more than three times the rate of inflation.

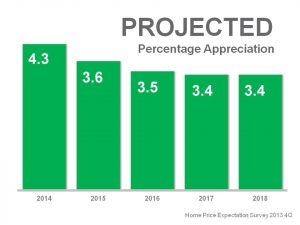

What can we expect for home prices next year? The Home Price Expectation survey is conducted nationwide among a panel of over 100 economists, real estate experts and investment and market strategists. This survey projects an average of 4.3% home appreciation for 2014. Rates continue to appreciate, though at a slightly slower pace, from 2015-2018. What does this mean for homeowners today? Appreciation will continue to grow in the next few years, and your assets will be gaining value above the rate of inflation.

Categories: Quarterly Newsletter

Leave a Reply